In the City of Los Angeles, a flood of inventory of $5 million + homes is a real possibility if Measure ULA passes November 8th. Measure ULA proposes to add a special tax when high-end properties sell to raise funds to build and acquire properties for the homeless population, as well as provide funds for homeless prevention measures.

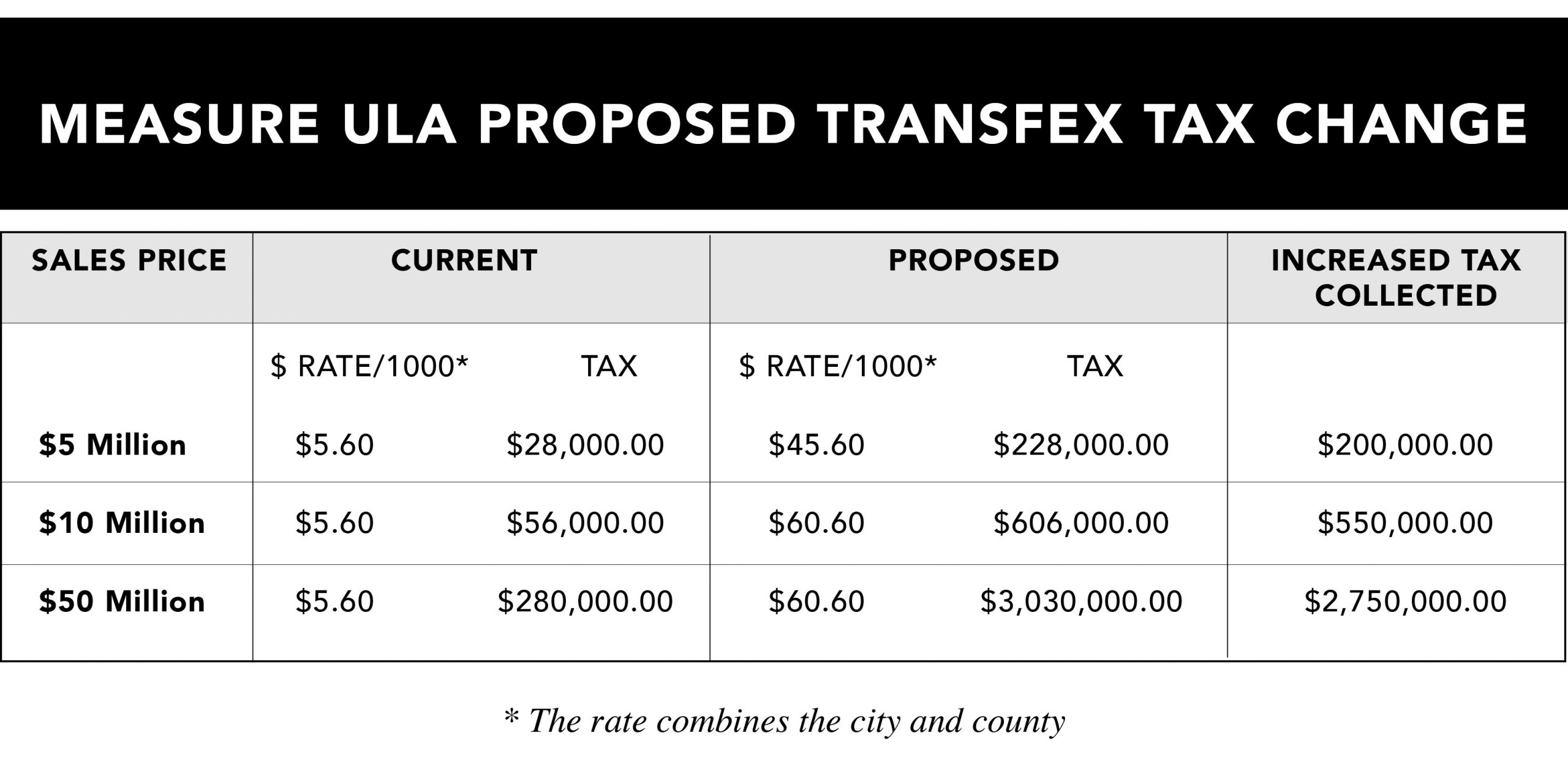

Currently, when a property sells, 0.45% is charged the seller as a transfer tax and the money raised goes into the city’s General Fund. Measure ULA will significantly increase the cost to sell. Sellers of $5 million up to $10 million properties will be charged an additional 4% of the sales price. Sellers of $10 million and above properties will be charged an additional 5.5%. The additional money raised will be earmarked for several approaches intended to deal with the homeless crisis facing the city. Supporters of the measure estimate that $923 million annually will be raised and that it will impact approximately 4% of annual transactions. Of course, if you are one to those owners and you are thinking about selling, I encourage you to learn more about this ballot measure. Some of these sellers may follow other Californians leaving the Golden State.

Currently, when a property sells, 0.45% is charged the seller as a transfer tax and the money raised goes into the city’s General Fund. Measure ULA will significantly increase the cost to sell. Sellers of $5 million up to $10 million properties will be charged an additional 4% of the sales price. Sellers of $10 million and above properties will be charged an additional 5.5%. The additional money raised will be earmarked for several approaches intended to deal with the homeless crisis facing the city. Supporters of the measure estimate that $923 million annually will be raised and that it will impact approximately 4% of annual transactions. Of course, if you are one to those owners and you are thinking about selling, I encourage you to learn more about this ballot measure. Some of these sellers may follow other Californians leaving the Golden State.

Sellers leaving expensive coastal markets have hit their highest levels since 2019. In 2022, 34,832 Angelinos moved elsewhere, the second largest outflow behind San Francisco. San Diego and Las Vegas were the top destinations for our former neighbors, according to Redfin. An influx of houses hitting the market and forcing prices down just hasn’t happened. Nationally, August saw 7% fewer listings compared to 2020 and 43% fewer compared to 2019. Another way to look at it, this year buyers have five houses to choose from, but had only four last year. Compared to last year, the number of active listings in August was flat in Beverly Hills, up 1.4% in Santa Monica and up 10.4% in Los Angeles. And the low inventory level persists while the escrow cancellation rate remains at historic highs. Per Redfin, 64,000 or 15.2% of escrows cancelled in August nationally, slightly down from July’s high of 15.5%, but well above August 2021’s 12.1% rate. New listings also dropped in August, which is not news.

What is news? The Real Deal reported that the declines in new listings hit its 10th consecutive week to 13% annually across the nation. The drop in new listings cannot be explained by just vacations and school starts. Beverly Hills, Santa Monica and Los Angeles experienced 23.3%, 25.7% and 14.7%, respectively in declines this August compared to the previous year. Not surprisingly, sales are down. California year-to-date sales were down 14.9% in August and existing homes sales were down 24.4% from August last year according to the California Association of Realtors. Southern California dipped 28.8% versus last year. Local markets suffered similar if not higher declines. Beverly Hills was down 40% year-over-year, Santa Monica 23% and Los Angeles 28%. Pending sales are also down according to the National Association of Relators.

In the U.S. pending sales dropped 24% in August compared to a year ago and dropped 31.3% in the West. Despite the continued low inventory levels, the median number of days it took to sell a California single-family home was 19 days in August 2022 and nine days in August 2021. Locally, the stats are very different. In Beverly Hills, the days on market was down 8% vs. August 2021. Los Angeles is down 3%, but in Santa Monica, the average market time increased 20%. Sales prices, however, continue to climb. Using the average sold price per square foot, local sellers have continued to see gains this year when compared to August 2021. In Beverly Hills, sellers saw an increased price average of 13%, while Santa Monica and Los Angeles sellers saw increases of 10.2% and 3% respectively. According to The Real Deal, the week of September 15th saw an annual increase in the median list price of 11.7% – the 39th consecutive week of a double-digit increase. However, in August 19.4% of sellers reduced their asking prices, according to Realtor.com. This is up from 11% earlier in the year. Overall, sales are down, prices are up and inventory supply is still below demand, although improving slowly. As Realtor.com’s Chief Economist Danielle Hale wrote, “The big shift in inventory that helped shift the market in a buyer-friendly direction has lost some momentum.”

Mortgage rates will certainly have some impact as the Fed continues to raise rates. Now buyers are finding mortgage rates as high as, if not more than 6%. Still, historically low rates but to buyers planning on 4%, it’s a shock. In fact, mortgage applications are down 28.6% vs. a year ago for the week ending September 9th, according to the Mortgage Bankers Association (MBA). Nevertheless, the actual rate is less important to buyers than their ability to service the debt. For the week of September 9th, the MBA reported that Adjustable-Rate Mortgage applications rose 9% year-over-year. To recap, mixed economic signals continue and I’m always available to help you decipher what they mean for your current selling or buying prospects.

I have a few ideas such as why you need a new approach in setting an asking price or how the Residential Purchase Agreement can help lessen the buyer’s mortgage costs. Please don’t hesitate to reach out to discuss how today’s overall residential real estate market impacts your specific property or plans for future purchases.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link