Here’s the current scenario for today’s residential real estate market: Buyers are talking about waiting for the big price drop to come. Some even say there will be a 15-20% decline. Sellers, on the other hand, bring up their property’s Zestimate on Zillow and the multiple offers the house across the street got last month. It’s become something of an impasse with no clear winner in sight.

Here’s the current scenario for today’s residential real estate market: Buyers are talking about waiting for the big price drop to come. Some even say there will be a 15-20% decline. Sellers, on the other hand, bring up their property’s Zestimate on Zillow and the multiple offers the house across the street got last month. It’s become something of an impasse with no clear winner in sight.

Both perspectives are right and both are wrong.

Economists at Redfin recently released a report that looked at the national market from June 5th to July 3rd, the time that the market changed due to the upswing in mortgage rates and the declines in the stock market.

In that period, 52% of homes sold above list price, which is down 1% from the same period a year ago. The average house sold 1.9% above list price and it took the same amount of time to sell this year as last. Across all sectors, the residential real estate market is still setting price records. The national median existing home sales price hit $416,000, up 13.4% versus a year ago. In Southern California home prices rose 8.4% year-over-year.

However, 7% of homes for sale each week during this time period reduced their asking price and 14.9% (60,000 escrows) canceled in June. That is the largest percentage of cancellations recorded, excluding the first two months of the pandemic, since Redfin began tracking cancellations in 2017.

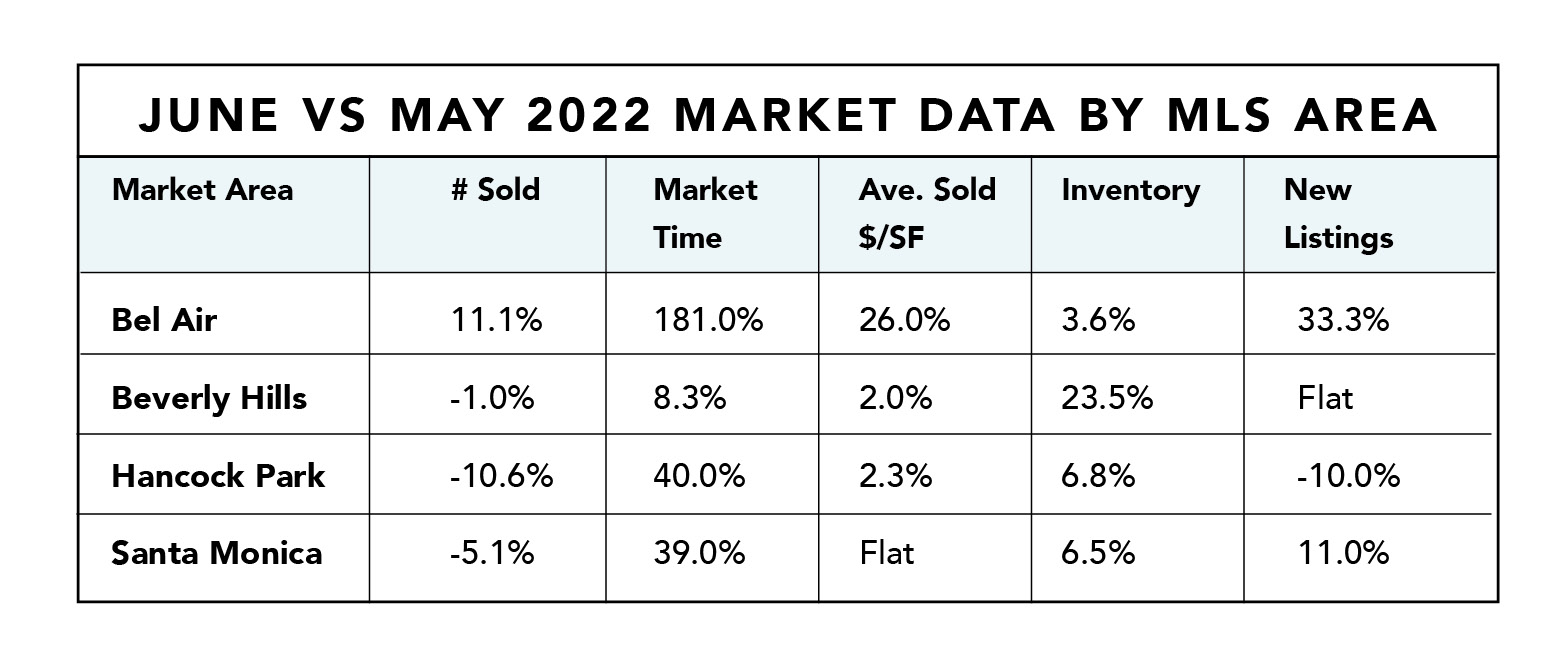

The impact on sales is just beginning. According to the National Association of Realtors (NAR), existing home sales dropped 5.4% in June from May and 14.3% from June last year. In the West, the NAR says sales declined 11.1% from May and 21.3% from June 2021. The California Association of Realtors (CAR) is projecting residential sales to be down 14.4% this year as compared to 2021. CAR also noted that the Southern California region has had the biggest year-over-year drop in unit sales: a 27.1% decline year-over-year.

The national inventory increased 9.6% from May and 2.4% versus June last year, according to NAR. CAR finds that active listings are up 64.4% in the state versus last June and up 28.8% from May.

If price reductions and inventory levels are increasing, why are sales prices also increasing? And why did Mark Zandi, Moody’s Analytics Chief Economist, predict on CNBC last Wednesday that real estate is going into a freeze with prices remaining flat for the next two to three years?

Supply and demand is the big picture answer. Supply is still going to remain low compared to buyer demand. When interest rates were at historic lows, many people either bought or refinanced. They have no motivation to sell a home financed with cheap money for a new property financed at a higher rate. Before Covid, the average homeowner stayed in their property five to seven years. The new market is going to see that timeframe expand.

Shouldn’t higher mortgage rates dampen buyer demand? Yes and no. Buyers care more about the monthly payment than the interest rate. And, the mortgage industry has responded…the Adjustable Rate Mortgage (ARM) has made a comeback. I’ve seen rate sheets with ARMs in the 4% range and 30-year fixed rates in the 5% range.

Another thing to consider is the comparable or “comp” price (what recent sales indicate a property should sell for). This data is always behind the action because the sales price is agreed to as much as 45 days prior to closing.

If inventory continues to remain low and buyers can find affordable, monthly mortgage payments, then we still have a seller’s market. It may not be as strong as it was last year or even three months ago, but that is good news.

“Homes listed competitively are still selling very quickly,” according to the Redfin economist and that’s the key variable in all of this: LISTED COMPETITIVELY. If the market, through lack of offers or showings, tells a seller that they have missed the competitive price point, they need to react quickly and make the necessary adjustment. I am observing this in both the current sales data and in conversations with colleagues. Homes priced just below a price justified by comparable sales are still receiving multiple offers. The days of 10 plus offers are over, but five offers aren’t unheard of now. And, with only a few offers, the sellers can optimize the selling price. Properties listed at “comp” prices seem to be sitting, taking price reductions and selling lower than expected.

To recap, there’s mixed economic signals out there and I’m always available to help you decipher what they mean for your current selling or buying prospects. Please don’t hesitate to reach out to discuss how today’s overall residential real estate market impacts your specific property or plans for future purchases.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link